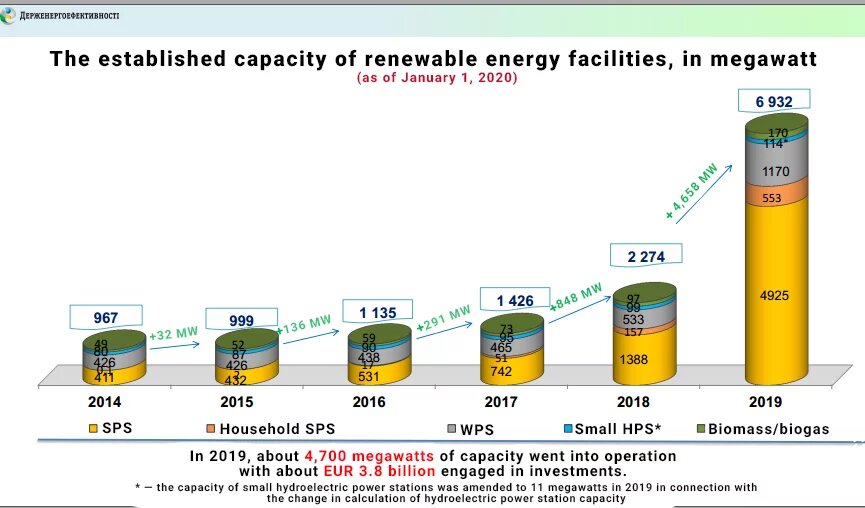

According to the State Agency for Energy Efficiency, the number of private and industrial solar and wind power stations is growing at an unprecedented rate in Ukraine. In 2019 alone, the capacity of newly operational renewable energy stations reached about 4,700 megawatt, with about EUR 3.8 million invested into this sphere.

Within a year, the number of private solar power stations grew by 350%, from 157 to 553 facilities. Big industrial solar power stations owned by companies which invest in solar energy has seen similar growth. All these items make a profit from the produced “green” energy, which is supplied to the grid, thus, they pay taxes to the budget.

We decided to analyze this situation practically and to model the situation to calculate what profit can be generated by amalgamated communities which develop renewable energy on their territory.

Let’s start with the structure of taxes for entrepreneurs with private or industrial solar power stations with a “green” tariff:

A big industrial solar power station with a capacity over 100 kilowatts:

Personal income tax (for employees) monthly: 18% of each gross paycheck. Up to 60% of the amount stays in the community budget; it is paid to the tax office where the enterprise is registered.

Land lease tax rate. If the land is not in private ownership, the community establishes the lease rate based on the estimated price of the land, as 3% to 5% of the price. This is paid to the local self-government agency which administers the land.

Social security — at the decision of the enterprise and after approval of the community, different help may be proposed instead, such as reconstruction of social infrastructure objects.

Single social tax (monthly): 22% of the gross paycheck. It is paid to the tax office where the enterprise is registered and forwarded to the retirement fund.

Private household solar power stations with capacity up to 30 kilowatts:

Personal income tax: 18% of the monthly revenue for the generated “green” energy.

Militaxy tax: 1.5% of the monthly revenue.

The taxes are withheld by the oblast distribution network; thus, the owner of the private solar power station gets net revenue to his or her account.

On the experience of the community in Volyn oblast

Roman Trotsiuk, head of Dubivska amalgamated community (Volyn oblast) tells that the community started developing renewable energy as recently as 2018. Now, there are 8 private solar power stations under 30 kilowatts in the community, as well as one industrial station of 1 megawatt capacity, plus a pellet factory.

“As for private solar power stations: people became interested in the ‘green’ tariff; they had money to invest into this business, and it has become their passive income. An industrial solar power station is a different ballgame altogether. Local people will be working there, and 60% of the personal income tax will go to the local budget,” explains Roman Trotsiuk.

According to Mr. Trotsiuk, the revenue agent withholding and paying taxes on behalf of solar power station owners is the oblast organization Volynoblenergo, which means that it is the oblast budget that gets additional revenue.

“We are now seeking advice and looking for ways how to direct personal income taxes directly into the community. As of today, Volynoblenergo is registered in [oblast capital] Lutsk, which means that’s where all the taxes from small solar power stations go. If all taxes from solar power stations stayed in the community, we would have an extra UAH 120,000,” he explains.

The 1-megawatt industrial solar power station went into operation at the end of 2019. It will be serviced by local experts, which means that jobs are preserved in the community. According to Roman Trotsiuk, 60% of the personal income tax will be sent to the amalgamated community budget, because the station belongs to entrepreneurs registered in the community.

The community can also generate additional budget revenue by leasing out land for industrial solar power stations.

Dubivska amalgamated community considers various options of renewable fuel which are less harmful to the environment and more efficient than gas. For instance, the community has established a modern heating station working with solid fuel and uses biofuel to heat the local school and kindergarten.

The head of the community emphasizes that the transition to solid fuel is not always more financially efficient than the use of gas. You need to take into account the wages of employees who service biofuel heating stations and to calculate the break-even point, especially in small projects. Some more factors to consider are taxes and the impact of the project on the community.

What Do Owners of Solar Power Stations Think?

Serhii Zaporozhets, owner of a 15-kilowatt household solar power station, not only uses the “green” tariff, but has also managed to create a small business project out of installing low-capacity solar power stations in communities. Serhii has shared information on the economic benefits not for the communities, but for solar power station owners, and the risks of such a business.

Serhii has spent USD 4,000 on the equipment (the calculation is USD 600 per 1 kilowatt of capacity). According to him, the station took 2.5-3 years to break even. On average, he makes a net profit of UAH 8,000 per month.

According to Serhii, the average annual revenue from the sale of solar energy is about UAH 55,000.

Let’s look at his monthly income and taxes.

- UAH 8,000 — net profit;

- UAH 120 — military tax;

- UAH 1,440 — monthly personal income tax.

Let’s say that during the three coldest months, the station does not generate enough extra power for sale.

UAH 1,440 x 9 months = UAH 12,960 of taxes annually paid to the budget by the owner of a household solar power station with the capacity of 15 kilowatts.

According to Serhii’s calculations, in theory, a 30-kilowatt station can generate a net profit of up to USD 1,000 per month. But the initial investment needs to be much higher, too. During a year, a 30-kilowatt solar power station can generate up to USD 8,000 of net profit.

Let’s use this example for our calculations.

USD 8,000 x 26.5 (USD to UAH rate) = UAH 212,000 of annual net profit.

In addition:

UAH 212,000 / 18% of personal income tax = UAH 38,160 of annual tax paid by the owner of a 30-kilowatt solar power station.

The net profit of solar power station owners is also public money. UKRENERGO covers the expenses of its oblast departments if the money has been spent on purchase of “green” energy from solar power station owners.

What Is the Situation with Big Industrial Solar Power Stations in Ukraine?

As of January 2020, there are 4,925 industrial solar power stations in Ukraine. The calculations are a little more complicated here. They require major initial investments and extra funds for salaries of their employees (such as electricians, accountants or security guards).

Let’s look at an example where a private solar power station is serviced by 10 officially recruited employees.

The average monthly paycheck in Ukraine as of January 2020 is UAH 10,727.

UAH 10,727 / 18% of personal income tax per employee = UAH 1930 of monthly tax paid to the local budget. Multiplied by 10 employees, that’s UAH 19,308 of the total monthly tax paid by the enterprise to the local budget.

UAH 10,727 / 22% of the social security tax = UAH 2,359 per month per employee.

2,359 x 10 employees x 12 months = UAH 283,080 of social security taxes paid by the owner of the industrial solar power station in a year for 10 employees.

In addition, the owner of an industrial solar power station has to pay an annual fee for land rent to the budget of the community where the station is installer or buy the land. But the biggest challenge for the investor is the task of changing the target use of the land. According to the National Geological Cadastre, land with an installed industrial power station must have the official target use “energy land.” In addition to that, you need to pay for the connection services of UKRENERGO or an oblast distribution network and for paperwork.

The investor is also supposed to make a social contribution into the community where an industrial solar power station is located. Apart from creation of jobs, the enterprise may help the community with repairing roads or other infrastructure items. The amount of the contribution depends on the agreement between the community and the enterprise.

Even so, industrial solar power stations are still really profitable in Ukraine. According to Serhii Zaporozhets, an industrial solar power station with the capacity of 100 kilowatts can generate about USD 20,000 per year for its owner. If you look at a station with the power of 1 megawatt, you can multiply that number by 10.

Companies which produce energy at big industrial solarpower station can participate in the national auction for power supply since January 2020. If they win, they can sell power to the government for 5 years (according to the Directive of the Cabinet of Ministers of Ukraine No.1175 of December 27, 2019).

How much will solar power station owners pay to the community or the oblast budget in taxes?

Let’s model a situation with a community with:

- 5 household stations of 10 kilowatts each with the “green” tariff;

- 3 household stations of 30 kilowatts each with the “green” tariff;

- 1 industrial solar power station with 15 employees.

How much money will be generated in taxes in one year? (The calculations are approximate.)

5 household stations of 10 kilowatts = UAH 64,800, out of which UAH 38,880 may stay in the community or oblast budget.

3 household stations of 30 kilowatts = UAH 38,160, out of which UAH 22,896 may stay in the community or oblast budget.

1 industrial solar power station with 15 employees — UAH 426,620 (annual amount of the social security tax for 15 employees) + UAH 347,400 (annual income tax for 15 employees), out of which UAH 208,440 stays in the community or oblast budget = UAH 774,020 paid by the economic entity in one year.

If the land for the industrial solar power station is leased from the community, the amount of budget contribution will increase.

Overall, the annual local (or oblast) budget revenue from these economic entities will constitute about UAH 696,836, plus another UAH 180,000 to the national budget.

Here are the main prerequisites for a successful cooperation of the communities and renewable energy companies:

- A responsible and grateful partnership.

- No corruption schemes.

- Timely and scrupulous payment of taxes.

For the government, the priority is to keep the taxes from the local RES in the treasury of the community itself. Such taxes have to go to the local community budgets, not to the oblast center or the national budget. This will constitute true, honest decentralisation and stimulate the development of renewable energy in Ukraine.

Author: Margaryta Mostova for the website Energy Transition.