Renewable Energy Support in Germany and Ukraine: Comparing Past and Present Right

On September 23, the seminar “Renewable Energy Support in Germany and Ukraine: Comparing Past and Present Right” took place online. The guests were Dr. Christian Redl, Senior Coordinator with Agora Energiewende, one of Germany’s leading think tanks, and Alina Sviderska, cofounder of Clean Energy Lab. The full video of the event can be found here. Presentation by Dr. Christian Redl and Alina Sviderska.

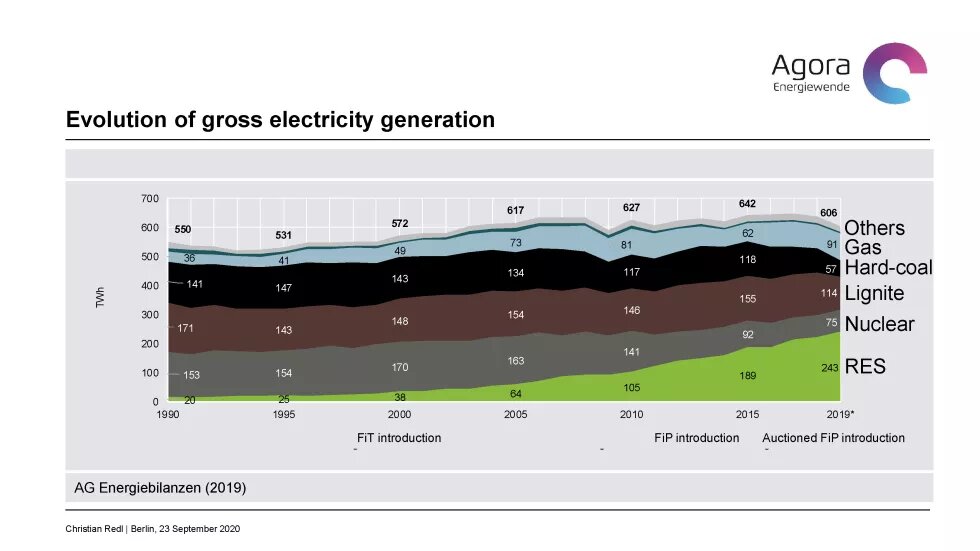

Dr. Christian Redl spoke about the evolution of support to renewable energy in Germany and its impact on the electricity market overall. In 2019, RES accounted for 40% of all energy sources in Germany, mainly wind and solar power plants, as well as biomass. “There is always a claim that RES cannot fully replace nuclear, but as we can see in this graph, the total annual production of renewables makes up for the nuclear and coal generation over the last years.”

Given the rise in CO2 prices in the EU emissions trading system, coal-fired power plants are becoming less competitive. The transition to RES is the main challenge in the energy transition process. Germany’s official goal is to have RES account for 65% of the power consumption in the country by 2030. The least expensive option is to increase the share of wind and solar energy. However, with regard to biomass and hydropower, there are limitations:

- biomass is quite expensive, subject to land use restrictions and has shortcomings in terms of sustainability;

- hydropower cannot be used extensively due to topographic circumstances;

The Renewable Energy Act was passed in Germany in 2000 and has since been amended several times to affect the development of RES, foster healthy competition and balance different energy sources. Between 2007 and 2013, electricity prices for the German population were growing every year; however, in 2013, the growth ended and now, the price remains more or less stable.

The biggest challenge for the German energy sector now is to overcome the growth of RES costs during 2018–2025. When this threshold is overcome, the production cost of RES will decrease, while the share of their consumption will grow. There are several reasons for this:

- maintenance of RES power plants will become cheaper;

- in 2021, most old plants will be put out of commission having exceeded the maximum maintenance period of 20 years;

- rising carbon prices will make fossil fuel production more expensive.

Wind and solar energy are competitive compared to other forms. However, they are also variable forms of energy generation, and this needs to be considered and requires a completely new approach. We need stations that will work 24/7, will be connected to each other in a network, which in turn will be connected between countries.

Renewable energy affects the structure of the economy as a whole. Financial structures and power markets were created based on the assumption that electricity generation has relatively low fixed costs but high operational costs. However, in case of wind and solar stations, they, conversely, have high fixed costs but low operational costs.

Renewable energy sources have a high potential. To enable the RES system to function fully, the following needs to be done:

- elimination of regulatory barriers and reduction of financial risks for small and large RES participants;

- gradual reduction of coal energy;

- strategic planning, taking into account climate change;

- cooperation at the regional level and reform of the electricity market.

If the regulatory framework is sound and the government provides procedural support for the construction of new facilities, renewable energy may be cheaper than coal. To develop sustainable energy and ensure fair energy transition, the European Union initiated the European Green Deal which stipulates: the goal of achieving climate neutrality on the legislative level by 2050; development of sectoral measures to reduce emissions and resource consumption; public and private investments aimed at protecting climate and sustainability; inclusion of the climate policy component in international trade.

In the next section, Alina Sviderska compared the development of RES in Germany and in Ukraine. Over the last year, green energy, the need to reduce tariffs and the energy transition have been a subject of increasingly lively debate in Ukraine, with Germany always being set as an example. However, when two countries are compared in such discussions, it is never mentioned how the system works in each of them. They have completely different approaches and experiences, though.

- Support for RES in Germany began in 1991, while in Ukraine in 2009, initially for limited circles.

- In Germany, RES-based power plants have been supported for 20 years, and in Ukraine for about 10, while the final date is the same — 2030.

- As for connection to the network, it is easier to get government support in Germany than in Ukraine. In Ukraine, network connection can take up to 40% of the cost of the entire project, which increases the eventual expenses.

- In Germany, the cost of electricity is mainly covered by the population, while in Ukraine, the opposite is true — most of the cost falls on business.

- Two years ago, a discussion around the auction system started in Ukraine. It was supposed to launch in April this year, but the launch has been postponed until 2021. In Germany, the auction system has been in effect since 2014 for solar energy and since 2017 for wind.

- The current auction price in Germany is 4–5 cents. In Ukraine, the price is still unknown, but hopefully about the same. Low prices are not about how good the technology is, but about what are the regulations and directives that Ukraine does not have yet.

The project LCOE will also be affected by the cost of capital and regulatory stability. In Ukraine, the cost of capital is 5–6 times higher than in Germany, and the rules of the market are changing retrospectively.